Investor Charter Depository Participant

1. Vision

JBS Securities is a Vision of Leadership, Quality and Astute Advisory incorporated as a Private / Ltd. Company / Partnership / Proprietary Firm. Since 1995, we have consciously constituted ourselves as a conscientious consultant with focus on optimizing investor returns taking into account investment objectives and financial goals.

2. Mission

- JBS Securities was established with a mission to provide trustworthy financial services under one roof. We strive to provide customized solutions for wealth creation and wealth growth resulting in high level of customer satisfaction with uncompromised integrity.

- To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

- To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

3. Details of business transacted by the Depository and Depository Participant (DP)

Depository participant is an agent of the Depository (NSDL & CDSL), and traders and investors. Essentially, a depository participant means a place that resembles a bank that stores money and conducts transactions. Instead of money, a depository participant acts as a store of assets such as securities. With a DP or depository participant, you can open a Demat account and store securities and then trade with them as your account may be linked with your trading account. Serving as an agent of one or both the NSDL and CDSL, a depository participant helps you manage your assets efficiently.

4. Description of services provided by the Depository through Depository Participants (DP) to investors

(1) Basic Services

Sr. no. | Brief about the Activity / Service | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

1. | Dematerialization of securities | 7 days |

2. | Rematerialization of securities | 7 days |

3. | Mutual Fund Conversion/ Destatementization

| 5 days |

4. | Re-conversion /

Restatementisation of Mutual fund units | 7 days |

5. | Transmission of securities | 7 days |

6. | Registering pledge request

| 15 days |

7. | Closure of demat account

| Depositories to accept physical DIS for pay-in of securities upto 4 p.m and DIS in electronic form upto 6 p.m on T+1 day

|

(2) Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include

Sr. no. | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

1. | Value Added Services

| Depositories also provide value added services such as a. Basic Services Demat Account (BSDA) b. Transposition cum dematerialization c. Linkages with Clearing System d. Distribution of cash and non-cash corporate benefits (Bonus, Rights, IPOs etc.), stock lending, demat of NSC / KVP, demat of warehouse receipts etc. |

2. | Digitalization of Services provided by the depositories

| Depositories offer below technology solutions and e-facilities to their demat

account holders through DPs: CDSL- web.cdslindia.com/myeasi/home/login |

5. Details of Grievance Redressal Mechanism

(1) The Process of investor grievance redressal

Sr. no. | Sr. no. | Sr. no. |

|---|---|---|

1. | Investor Complaint/ Grievances

| Investor can lodge complaint/ grievance against the Depository/DP in the following ways: a. Electronic mode – SCORES (a web based centralized grievance redressal system of SEBI) www.scores.gov.in/scores/Welcome.html (i) Respective Depository’s web portal dedicated for the filing of compliant CDSL – www.cdslindia.com/Footer/grievances.aspx CDSL – complaints@cdslindia.com (iv) Emails to designated email IDs of depository Participant complain@jbsindia.in The complaints/ grievances lodged directly with the Depository Participant shall be resolved within 30 days. |

2. | Investor Grievance Redressal Committee of Depository Participant

| If no amicable resolution is arrived, then the Investor has the option to refer the complaint/ grievance to the Grievance Redressal Committee (GRC) of the Depository. Upon receipt of reference, the GRC will endeavor to resolve the complaint/ grievance by hearing the parties, and examining the necessary information and documents. |

3. | Arbitration proceedings

| The Investor may also avail the arbitration mechanism set out in the Byelaws and Business Rules/Operating Instructions of the Depository in relation to any grievance, or dispute relating to depository services. The arbitration reference shall be concluded by way of issue of an arbitral award within 4 months from the date of appointment of arbitrator(s). |

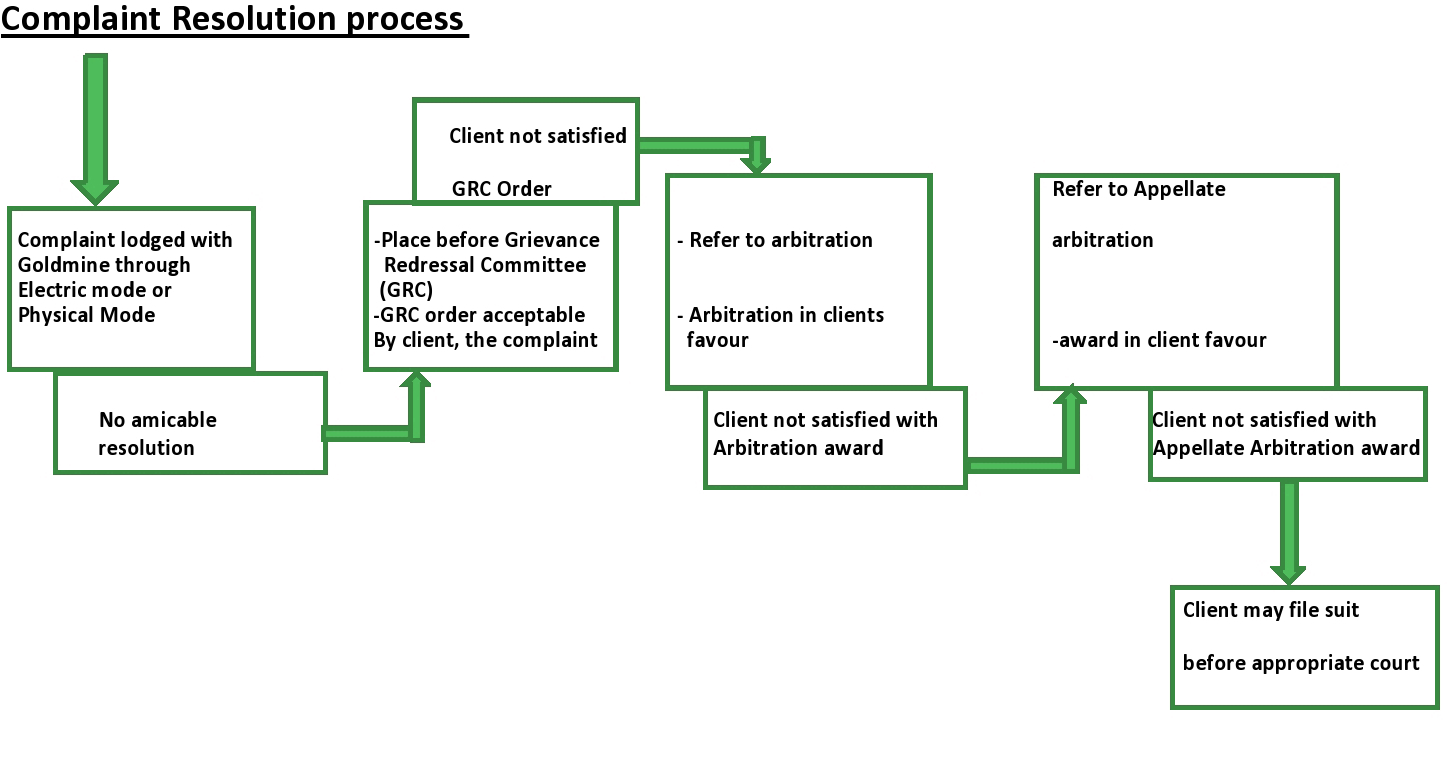

(2) For the Multi-level complaint resolution mechanism available at the Depository Participant

6. Guidance pertaining to special circumstances related to market activities: Termination of the Depository Participant

Sr. no. | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

1. | • Depositories to terminate the participation in case a participant no longer meets the eligibility criteria and/or any other grounds as mentioned in the bye laws like suspension of trading member by the Stock Exchanges. • Participant surrenders the participation by its own wish. | Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email.

|